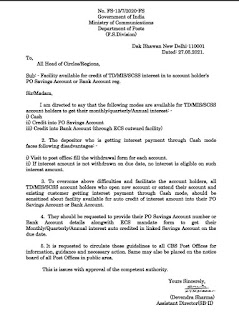

Facility available for credit of TD/MIS/SCSS interest in to account holder's PO Savings Account or Bank Account reg.

No. FS-13/7/2020-FS

Government of India

Ministry of Communications

Department of Posts

(F.S.Division)

Dak Bhawan

New Delhi-110001

Dated: 27.05.2021.

To

All Head of Circles/Regions,

Sub: Facility available for credit of TD/MIS/SCSS interest in to account holder's PO Savings Account or Bank Account reg.

Sir/Madam,

I am directed to say that the following modes are available for TD/MIS/SCSS account holders to get their monthly/quarterly/Annual interest:-

i) Cash

ii) Credit into PO Savings Account

iii) Credit into Bank Account (through ECS outward facility)

2. The depositor who is getting interest payment through Cash mode faces following disadvantages: -

i) Visit to post office; fill the withdrawal form for each account.

ii) If interest amount is not withdrawn on due date, no interest is eligible on such interest amount.

3. To overcome above difficulties and facilitate the account holders, all TD/MIS/SCSS account holders who open new account or extend their account and existing customer getting interest payment through Cash mode, should be sensitized about facility available for auto credit of interest amount into their PO Savings Account or Bank Account.

4. They should be requested to provide their PO Savings Account number or Bank Account details alongwith ECS mandate form to get their Monthly/Quarterly/Annual interest auto credited in linked Savings Account on the due date.

5. It is requested to circulate these guidelines to all CBS Post Offices for information, guidance and necessary action. Same may also be placed on the notice board of all Post Offices in public area.

This is issues with approval of the competent authority.

Comments

Post a Comment

Hello friends if you have any doubts feel free to comment here